Emergency Fund: Your Strongest Financial Asset

Every ounce of critical financial planning can go to waste if you don’t have an emergency fund to back it up. Emergency funds are a lifesaver when unforeseen expenses crop up.

There are emergencies that need immediate attention such as a daily-use home appliance breaking down or car repairs demanding early intervention. Because these emergencies usually require your immediate attention, attaching a debit card or a check-writing facility to your short-term emergency fund can be of use. You will have immediate access to your funds putting you in a position to use them whenever the need strikes.

On the other hand, a long-term emergency fund saving can get you out of the woods in case of dire emergencies, not under your control such as a natural disaster or job loss. Long-term emergency funds can be stored in investments which may take several days to liquidate. The short-term fund should hold you over until you’ve accessed these funds.

When Emergency Funds Really Save the Day

Realistically speaking, an emergency fund is not a “backup fund” you can use to buy anything you want. Learn to identify what a real emergency is and how it impacts your lifestyle in the long run. Examples might include:

- A family emergency requires your attention and you need to make travel arrangements right away.

- A major everyday appliance such as the dishwasher or refrigerator breaks down and you need it repaired/replaced.

- You currently don’t have health insurance and suffer from a critical illness or injury which requires immediate medical care.

- A car issue you can’t figure out which demands the attention of a mechanic.

- The basement gets flooded due to a water heater problem.

Pay Off Your Debt First

Before planning an emergency fund, make sure all your debts are paid off. Large amounts of debt can be a real thorn in your side, particularly if you are paying high interest on them. Settle your debts and, under all circumstances, avoid the urge to accumulate more debt. Failure to pay your debt means you will continue to accumulate more debt (interest etc.) and may end up in hot water if your lender goes the legal way.

First, you have to make sure you don’t owe any back taxes from the IRS. Tax debt should be settled first to avoid unnecessary seizure of any properties you owe. Consulting a tax professional can have many advantages. They can help you through tax law, taking into account your financial situation, so that you pay back the smallest amount that is legally owed.

If you owe unsecured debt such as credit card bills, getting into a debt settlement program is one way you can free up more money to deal with monthly expenses and help settle debts within a reasonable time frame. Avoid bankruptcy as much as possible by exploring your debt relief options and invest in a debt settlement program to find closure fast. Remember, bankruptcy can have a lasting mark on your credit report.

When Should You Save?

It is generally a good practice to pay off all your debts before you start focusing on emergency fund savings. However, it’s permissible to start saving while you have some debt if you’re making all your mortgage payments on time. Make sure all your monthly credit card payments are being taken care of. Finally, you shouldn’t have any loans that are high interest and really low in terms of savings.

High-interest charges on ‘expensive debts’ make it more challenging to finance your emergency fund, so you need to clear those first.

Why Do I Need an Emergency Fund?

You need an emergency fund to fall back on in case a financial emergency arises. Knowing you have cash in hand will keep you trouble free. In addition to this, there are several other reasons why you need an emergency fund:

- Life is unpredictable! You may lose your job or start making less money all of a sudden. In such times your emergency fund can be of much use. It will help cover your day to day expenses while you look for another job or ways improve your finances.

- Health emergencies can arrive anytime. Sadly, your health insurance may not necessarily cover every hospital visit or medication expense. Have an emergency fund plan and you’ll never have to play the choosing game between your monthly rent and your well-being.

- No matter how much we care, accidents can happen and may result in huge problems. Anything from your car breaking down to your house catching fire can be troublesome. In such conditions, your emergency fund can help bring you out of hot water.

A Backup Piggy Bank for Obligations, Not Entertainment or Desire

The whole idea behind emergency savings is to have a backup source for meeting life’s obligations, and not desires or what you consider ‘leisure’. Focus on the bare necessities only:

- Mortgage payments when finances are tight

- Automobile expenses outside of fuel and normal maintenance

- Insurance

- Utilities

- Food

- Healthcare etc.

There are taxes to be paid off and monthly or quarterly home maintenance. It’s always good to save a little extra which acts as a cushion should you find yourself unemployed.

Building Your Emergency Fund

When building your emergency fund, take the following into consideration:

How Big?

Your current financial status and insurance coverage decide whether you should have a big or small fund. Generally, it’s a good idea to have sufficient emergency savings to take care of 3-6 months’ worth living expenses. If you’re out of a job, it gives you enough time to find work while supplementing with unemployment benefits.

You need to do math and see how much you can afford to save every month after paying all your necessary expenses. Try to reduce unnecessary expenses so you can save even more.

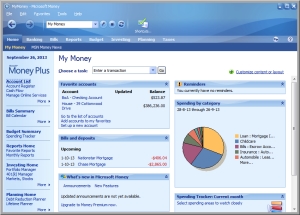

Where Do I Keep it?

You should keep your savings in an account that allows you to withdraw funds whenever you need it. A checking account is an ideal account since it has little to no restrictions on withdrawals. However, the downside is that you have to do away with interest in most cases.

On the other hand, you may also choose a savings accounts. Your money will increase slightly each month due to interest, but you may have to deal with certain restrictions on withdrawals.

Ideally, you should keep your money in two places. A larger amount in a savings account – untouched until you really need it – and a smaller amount in a place more readily accessible.

Steps to Take in Advance

- You need to have a monthly savings goal. Get in the habit of saving on a regular basis. Even a small percentage adds up. It can be a percentage of your net income or a fixed amount, such as $500 per month. You should let this amount decide your other expenditures as a rule.

- If there’s any money left in your checking account before the start of the next month, move some or all of it to your emergency account.

- When filing taxes, you might want to have your refund directly transferred to your emergency savings, as it could be in the thousands.

- If you’re not saving enough, consider cutting back monthly costs through carpooling, eating out less frequently, not throwing away leftovers or having coffee at expensive places.

- Get a second job or freelance doing what you love to save extra for your emergency cash savings. Sell unwanted items in your house.

- Every few months, it’s a good idea to check how much you’ve saved. This will help you see if you’re reaching your goals or if you need changes in your plan. Plus, knowing how much money you have will also allow you to take better decisions in case of an emergency.

Final Thoughts

Everyone needs to have an emergency fund for when things get rough. When you fail to have a cash reserve for these unexpected situations, you’ll be left with little choice but to reach for the credit card, which is something you want to avoid all together.

Say no to debt, find relief from it fast and always learn to distinguish between necessities and luxuries when saving up those extra dollars for emergencies.

Sources:

- http://www.finweb.com/financial-planning/the-importance-of-an-emergency-savings-fund.html#axzz4BG0MCvYt

- http://www.curadebt.com/debt-consolidation-options/

- http://www.moneysavingexpert.com/savings/pay-off-debts

- https://www.nerdwallet.com/blog/finance/life-build-emergency-fund/